ETD

Energy Taxation Directive

The ETD is the principal taxing scheme used for fossil and low-carbon fuels in EU

About ETD

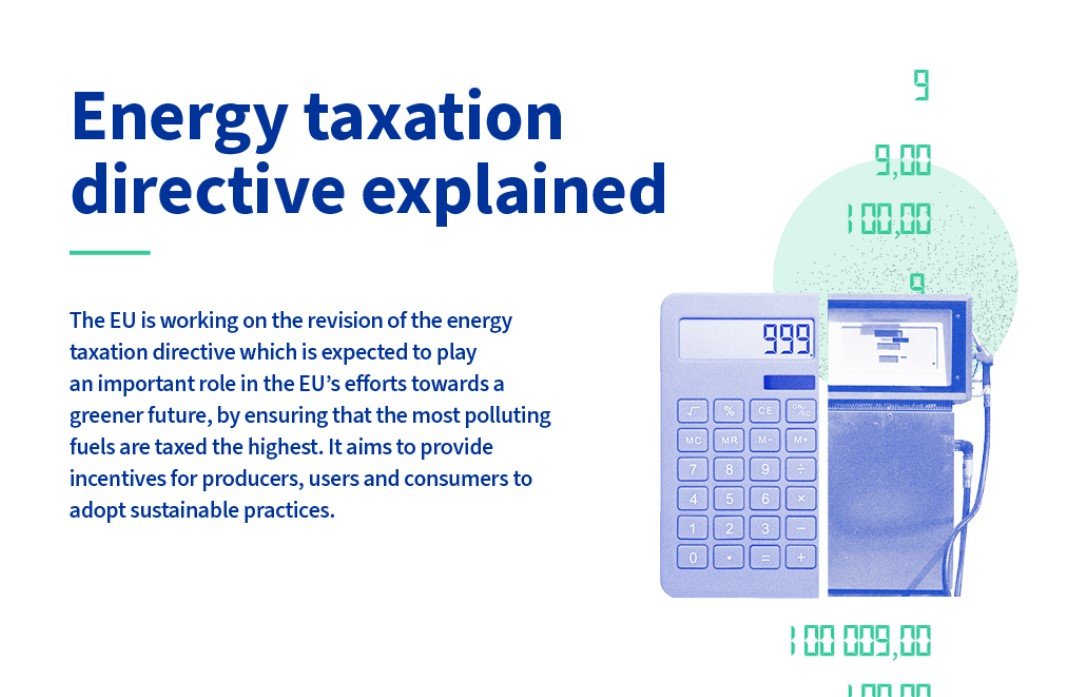

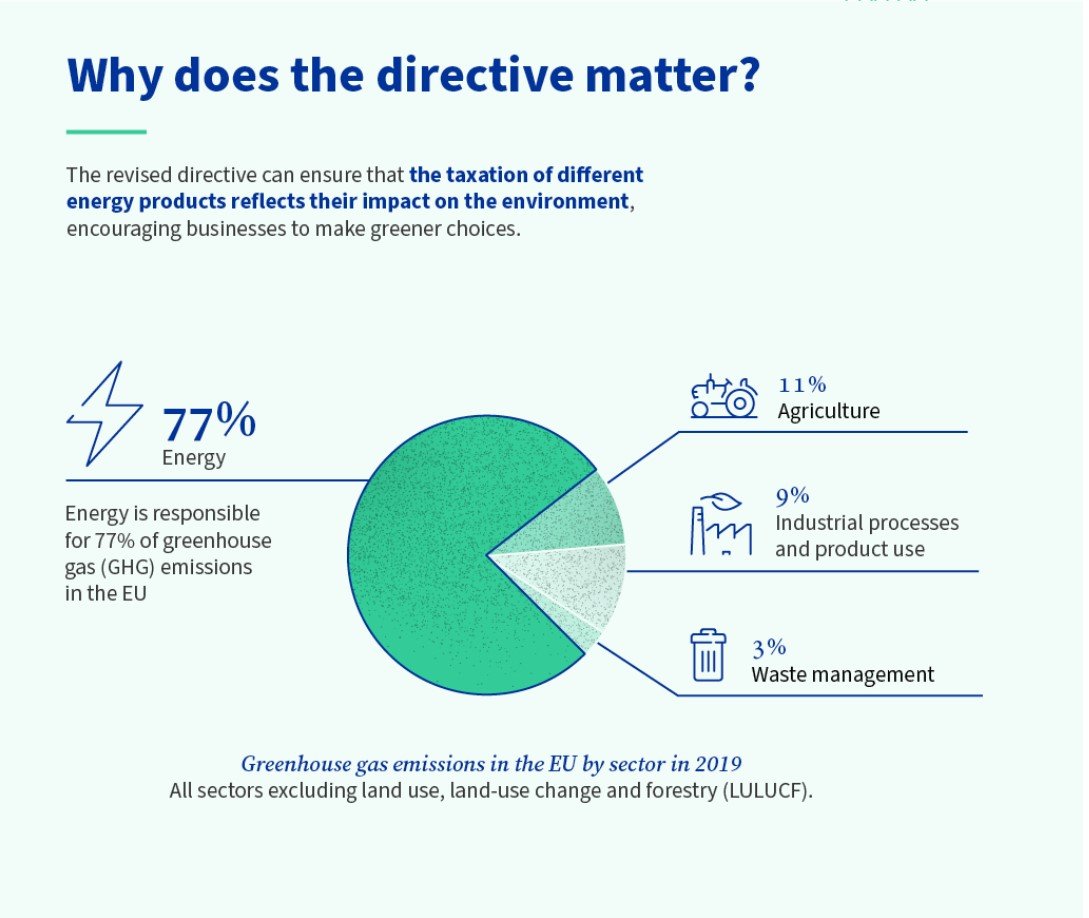

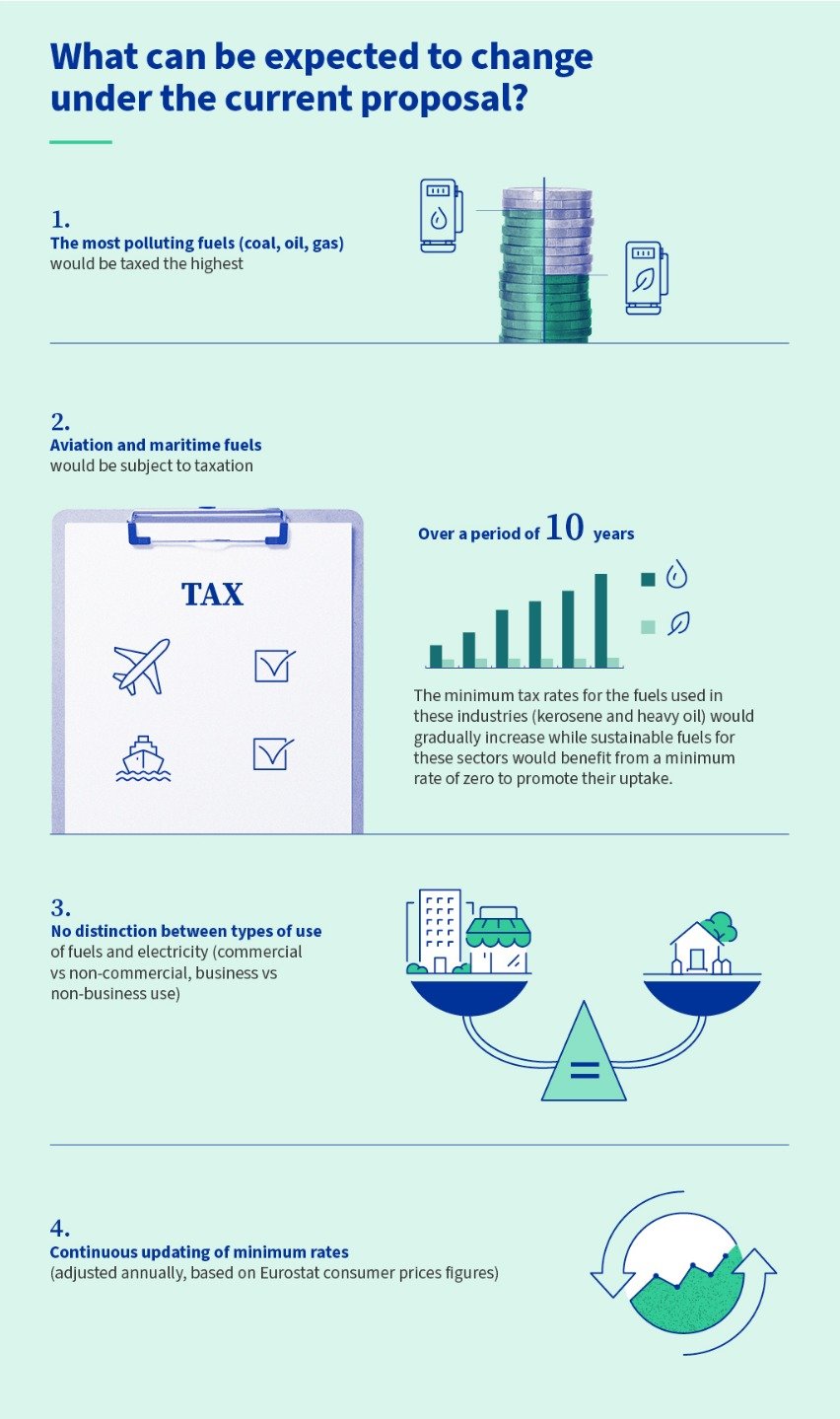

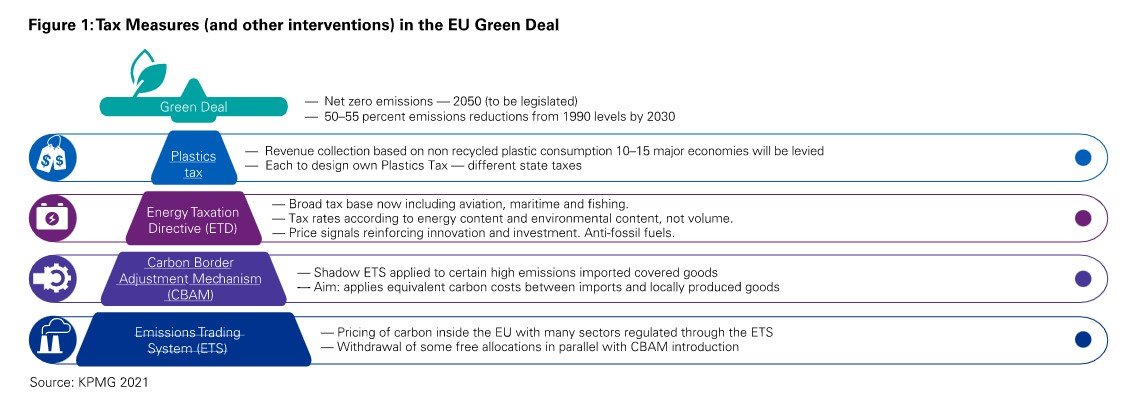

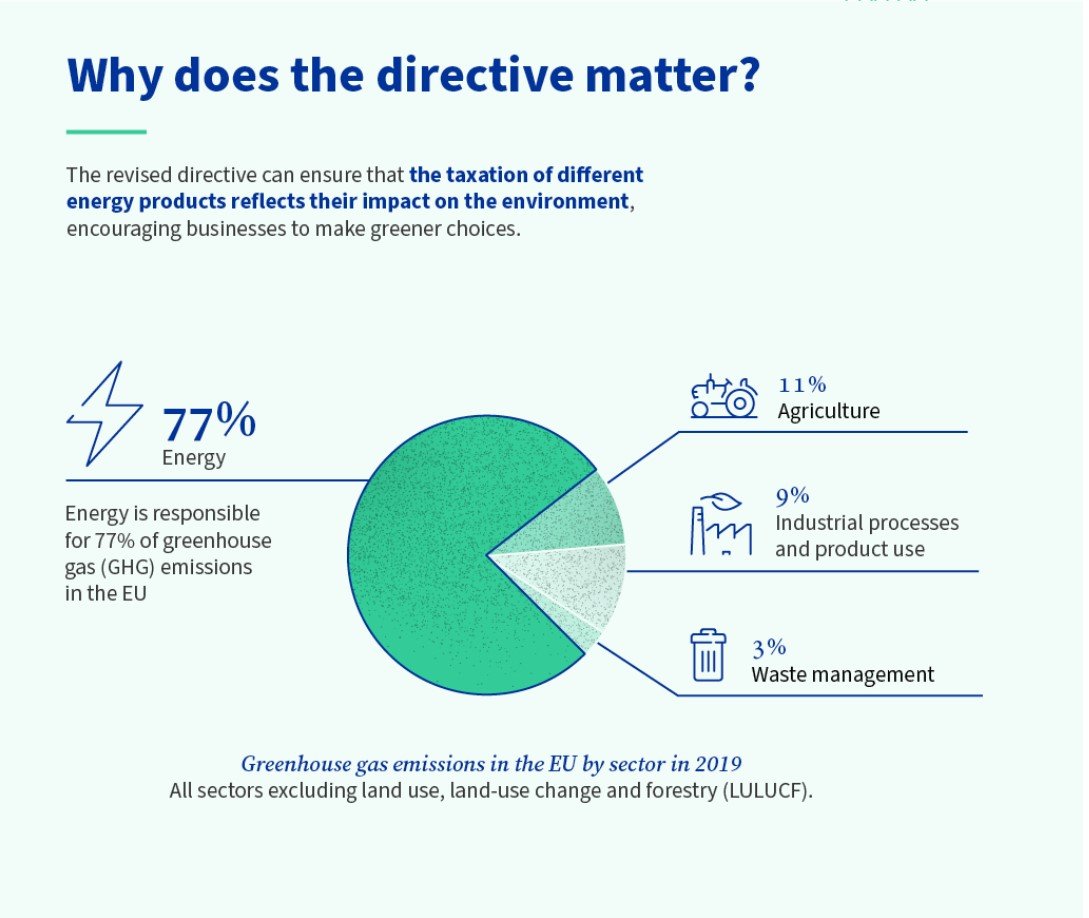

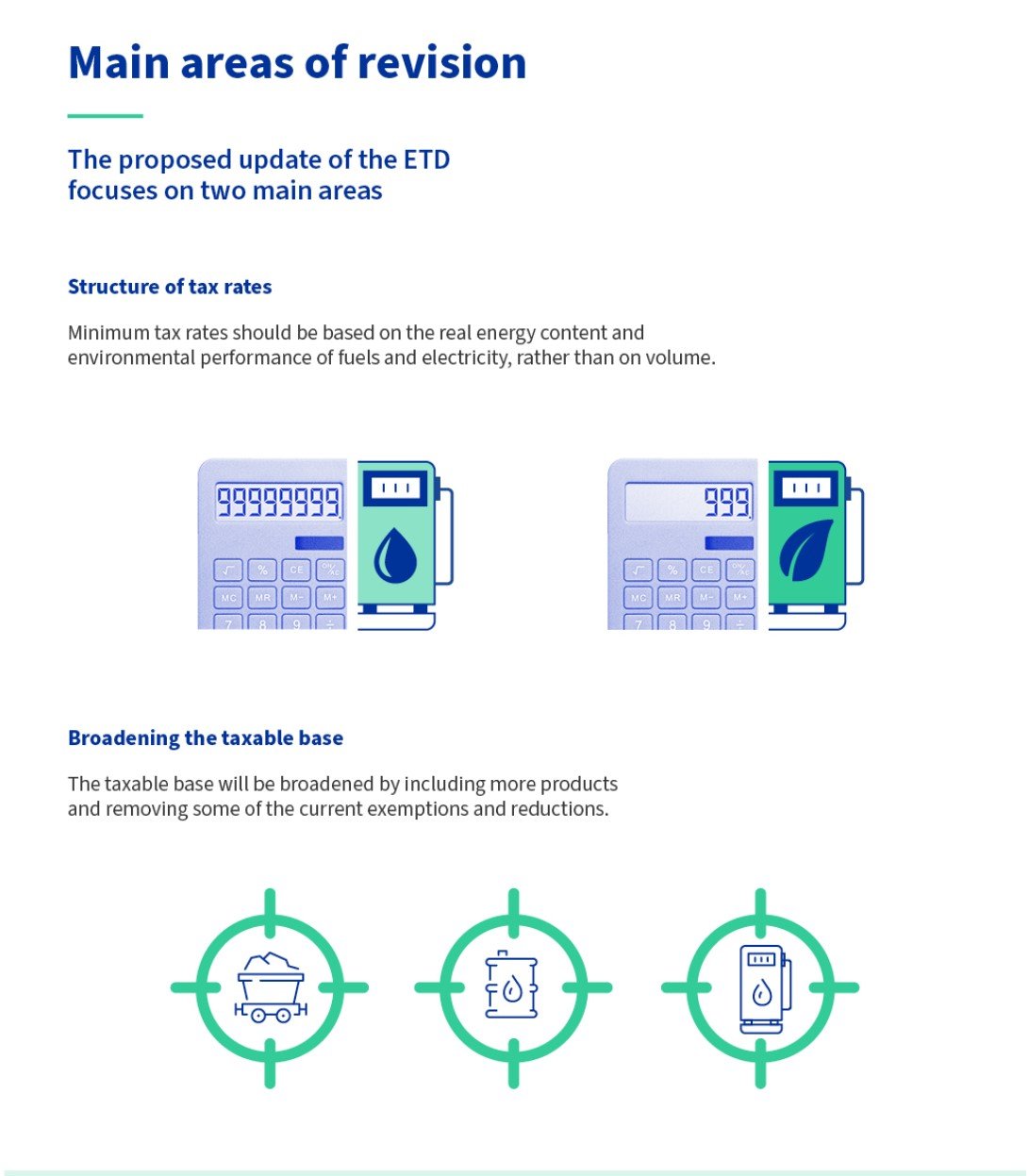

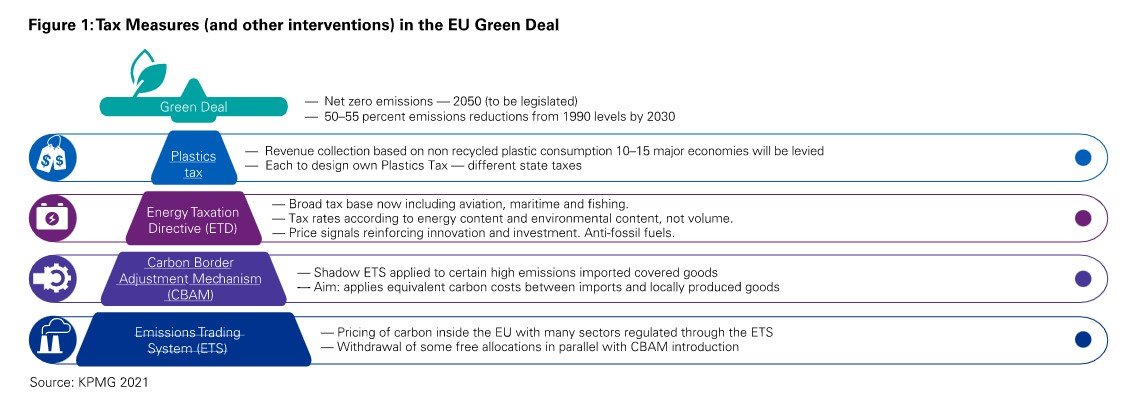

The EU’s fit for 55-package proposes a revision of the Energy Taxation Directive (ETD), which was adopted in 2003. The ETD would be updated to align with current EU climate and energy objectives, incentivize investment in clean technologies, no longer favor fossil fuels, and improve clarity and legal certainty for member states. The ETD currently employs a taxation mechanism that allows subsidies in favor of fossil fuels. Under the new revision, the fuels that pollute most will be taxed at higher rates.

For the shipping industry, energy products and electricity produced from fossil fuels used in waterborne navigation will be subject to taxation. Taxes will be calculated according to the net calorific value of the fuel. Tax exemptions will initially incentivize the use of sustainably produced alternative fuels, electricity and shore-side electricity used by vessels at berth. Working from a basis aligned with the established climate goals for 2030, there are three possible ETD variations under discussion:

Option 1 keeps much of the current scope, but includes intra-EU shipping, with transitional exemptions for certain sustainably produced fuels.

Option 2 introduces a system of minimum rates for intra-EU operations – based on energy content – which will increase over a ten-year transitional period. There are two possible variations of this option, one proposing a shorter transitional period, and the other the inclusion of air pollutants in the ETD’s scope.

Option 3 may not apply to the maritime sector, if the maritime sector is included in the EU Emission Trading System.

Points of Concern

The ETD proposal is still subject to change as it remains under discussion at both the EU Parliament and EU Council.* Points raised have included:

The need for a comprehensive assessment of all aspects of the Fit for 55 package

The introduction of a heavy fuels tax for the maritime sector

The clarification that only cleanly produced electricity can qualify for exemption status

The possibility of basing taxation rates on energy content rather than volume

References

EU - Infographic Fit for 55 and ETD

Stories