Maersk

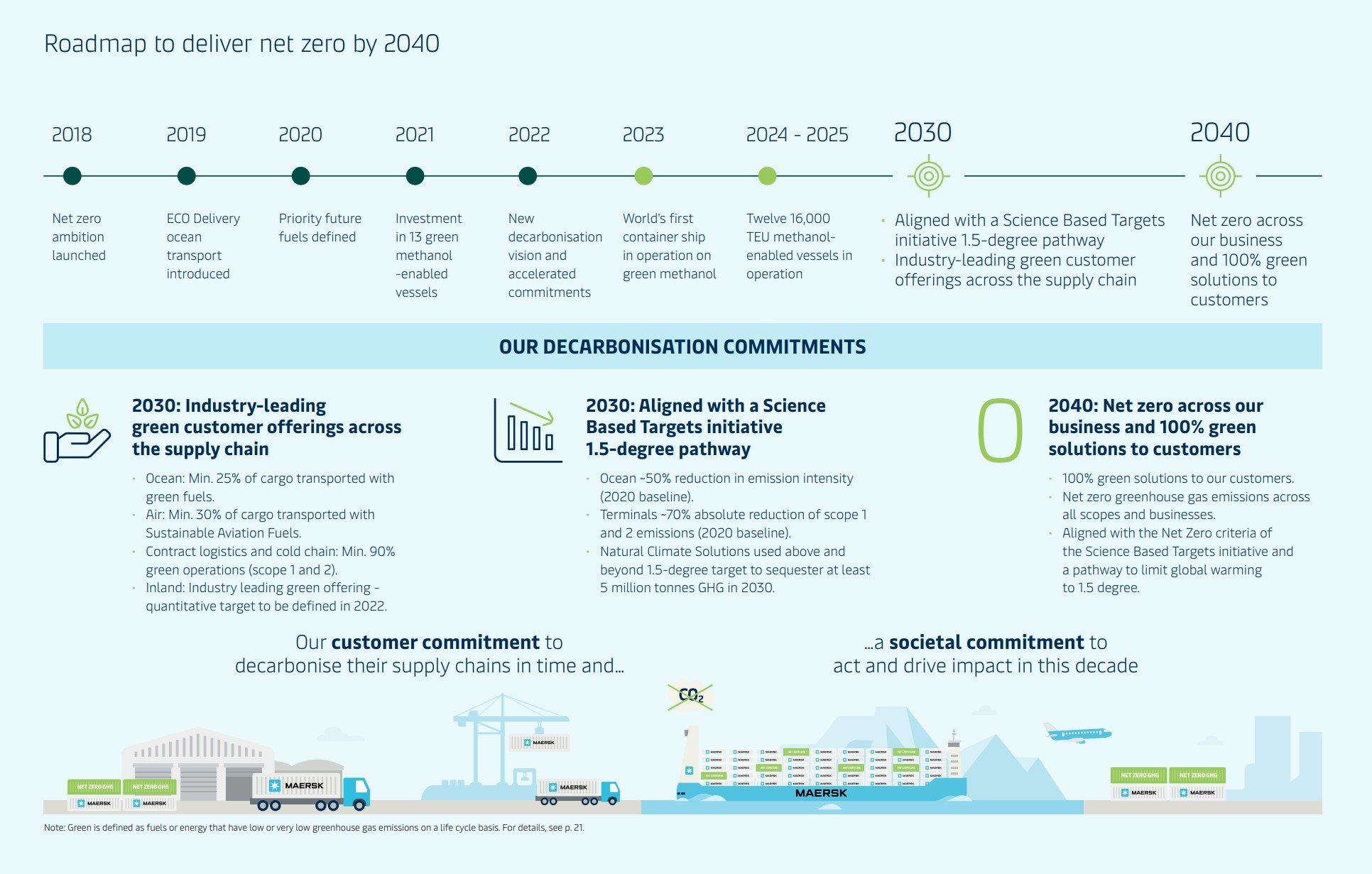

Maersk has committed to net zero CO2 emissions by 2040 and has thereby set the most ambitious targets, with intermediary targets for the coming years and 2030. Their focus is on biodiesel and methanol on the short-term, exemplified by the production of large 16,000 TEU vessels capable of operating on green methanol. Due to Maersk’s size and network, they have a significant influence on IMO and governmental decision-making, and they are actively engaging EU, UN and national governments on a wide variety of environmental and sustainability topics.

Technology focus - Biodiesel, methanol, ammonia

Sustainability Report

About Maersk

-

Evidently, Maersk directs most of their decarbonisation investments towards moving away from the use of fossil fuels to power their vessels. Maersk actively pursues the use of three types of fuels: biodiesel, green methanol and green ammonia.

Biodiesel is already used and requires very few adaptations. Green methanol seems to be the preferred fuel of choice, with plans for dual-fuel ships starting delivery in 2024. Green ammonia is a longer term measure and still a considerable longer way away from being ready to implement.

In 2021, Maersk Growth made minority investments in three start-up companies that typify the innovation needed across the value chain to develop available, cost-competitive sustainable fuels:

Prometheus Fuels – direct air capture-technology that combines renewable energy, water, and air into cost efficient, green electro-fuels.

WasteFuel – turning unrecoverable agricultural and municipal waste into sustainable aviation fuel, green bio-methanol and renewable natural gas.

Vertoro – developing liquid lignin technology, from sustainably sourced forestry and agricultural residues, which can be used as a marine fuel.

Shore Power

Decarbonization of terminals is an important part of Maersk’s strategy and they have a roadmap for net zero terminals in place. They are currently exploring opportunities to co-develop wind and/or solar farms together with local governments. Despite the importance of electrification and the switch to green energy mentioned in the 2021 sustainability report, shore power for vessels at berth is only mentioned once and no tangible roadmap or details on the development of terminals can be found.

Nonetheless it is known that Maersk is actively developing shore power technology, even to power vessels offshore. Together with Ørsted, they are developing and testing a prototype buoy in one of Ørsted’s offshore wind farms. The buoy can act as both a mooring point and a charging station for vessels, enabling vessels to turn off their engines when laying idle.

Partnerships

A survey from key investors and NGOs showed that by far the greatest interest is in the specifics of Maersk’s decarbonisation roadmap including interim targets and fuel strategy. Partnerships of Maersk reflect this interest, which include organisations such as Sustainable Shipping Initiative, Getting to Zero Coalition, Race to Zero, and of course the Maersk Mc-Kinney Møller Center for Zero Carbon Shipping. Due to their size and network, Maersk has great pull in rules and regulations and is actively lobbying with governments around the world. In particular with regards to climate change and environmental issues, which are increasingly high on the regulatory agenda for the maritime industry.

They have engaged with regulators in the EU, UN agencies and national governments on a wide variety of environmental and sustainability topics, including decarbonisation, ship recycling, clean air and future fuels. In some cases they have provided technical insights to relevant regulators, particularly at EU and IMO level. They have also engaged with EU representatives over elements in the EU Fit for 55 package, specifically in the area of decarbonising shipping. Other topics on our EU agenda have been the EU Taxonomy for sustainable activities and matters related to ship recycling.

Governance Structure

Governance of sustainability is anchored with the Board of Directors and the Executive Leadership Team. Ownership and responsibility to drive actions across the 14 categories is anchored in line of business to ensure alignment with business priorities and a long-term focus on ESG. A sponsor from the Executive Leadership Team is assigned to each category.

Across categories, a central Steering Committee representing key corporate functions ensure direction, coordination and subject matter expertise. Underlining the commitment to the strategy, the Board of Directors has committed to linking executive remuneration to key targets from 2023.

-

Decarbonization of terminals is an important part of Maersk’s strategy and they have a roadmap for net zero terminals in place. They are currently exploring opportunities to co-develop wind and/or solar farms together with local governments. Despite the importance of electrification and the switch to green energy mentioned in the 2021 sustainability report, shore power for vessels at berth is only mentioned once and no tangible roadmap or details on the development of terminals can be found.

Nonetheless it is known that Maersk is actively developing shore power technology, even to power vessels offshore. Together with Ørsted, they are developing and testing a prototype buoy in one of Ørsted’s offshore wind farms. The buoy can act as both a mooring point and a charging station for vessels, enabling vessels to turn off their engines when laying idle.

-

A survey from key investors and NGOs showed that by far the greatest interest is in the specifics of Maersk’s decarbonisation roadmap including interim targets and fuel strategy. Partnerships of Maersk reflect this interest, which include organisations such as Sustainable Shipping Initiative, Getting to Zero Coalition, Race to Zero, and of course the Maersk Mc-Kinney Møller Center for Zero Carbon Shipping. Due to their size and network, Maersk has great pull in rules and regulations and is actively lobbying with governments around the world. In particular with regards to climate change and environmental issues, which are increasingly high on the regulatory agenda for the maritime industry.

They have engaged with regulators in the EU, UN agencies and national governments on a wide variety of environmental and sustainability topics, including decarbonisation, ship recycling, clean air and future fuels. In some cases they have provided technical insights to relevant regulators, particularly at EU and IMO level. They have also engaged with EU representatives over elements in the EU Fit for 55 package, specifically in the area of decarbonising shipping. Other topics on our EU agenda have been the EU Taxonomy for sustainable activities and matters related to ship recycling.

-

Governance of sustainability is anchored with the Board of Directors and the Executive Leadership Team. Ownership and responsibility to drive actions across the 14 categories is anchored in line of business to ensure alignment with business priorities and a long-term focus on ESG. A sponsor from the Executive Leadership Team is assigned to each category.

Across categories, a central Steering Committee representing key corporate functions ensure direction, coordination and subject matter expertise. Underlining the commitment to the strategy, the Board of Directors has committed to linking executive remuneration to key targets from 2023.

Frequently Asked Questions

-

Description text goes here